This week we bring you a short half-year update on the gold and silver price, but after that we are once again forced to ask “What Are Central Banks Playing At?”. They have all the potential to do great things like a small child (if you will) but also like a small child they keep shaking a broken toy asking why it’s broken and continuing to do the very things that broke it in the first place. Nothing right now suggests they know what they’re doing or that they are prepared to learn. Luckily for us, we know what happens next…that’s why we invest in gold and silver bullion.

Gold and silver started the year off in a strong upswing that seems to have fizzled out as we approach the mid-year point. In US dollar terms gold rose more than 26% and silver rose a substantial 46% from September 2022 lows to the mid-April 2023 high. But since gold has moved somewhat sideways and silver has given back some of the increase.

The two metals sit in precarious spots from a technical analysis point as they test support levels and uptrend lines. The metals prices are roller coasting with each economic and monetary policy decision, especially U.S. data and Federal Reserve policy. It is not only metal prices but also bonds and equities that are stuck in this roller coaster ride.

The below cartoon from Bob Mankoff seems especially relevant in the current financial environment.

The Disconnect

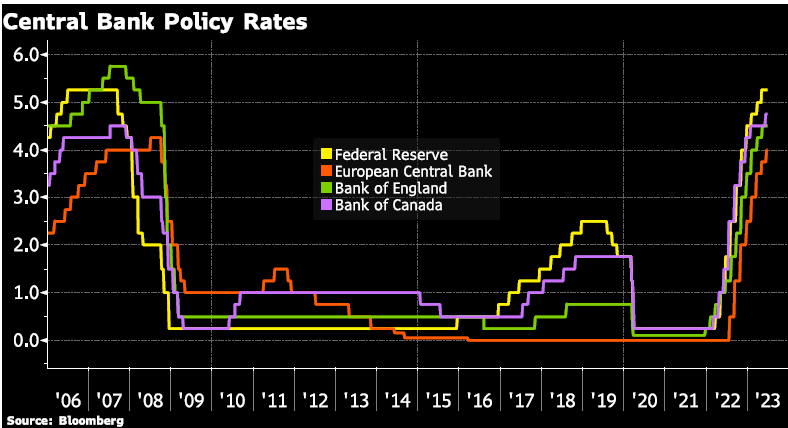

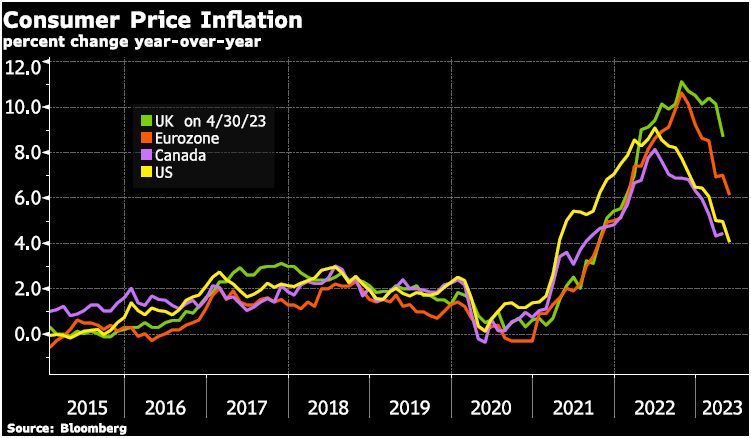

There seems to be a disconnect in economic and financial data of late. Central banks have been on an interest rate-raising crusade since March 2022, as they try to squash inflation growth back down to their 2% targets. The Fed, for instance, raised rates over 10 consecutive meetings for a total of 5% higher rates before pausing at its meeting last week (see our post A skip, a pause, a shift? … What’s next for the Fed?) but signaled that more interest rate hikes are ahead.

These Fed forecasts hikes are despite the same officials projecting lower economic growth and higher unemployment. Other central banks are also hiking rates despite troubling signs in housing markets, and banks.

The Fed and other central banks are in a tug-of-war between inflation and emerging economic problems. Almost all central bankers have admitted that monetary policy works with a lag.

How long and to what extent the lag affects the economy is a highly debated topic as it is difficult to completely isolate the effects of monetary policy from other economic factors, and higher rates are not only a one-time hit to an economy but a multi-layer hit. Estimates on the lag time are up to 2 years to take full effect.

Be patient, the true damage is coming

This means that with the rapid increase in rates only starting 18 months ago that even the first interest rate increases have not fully taken effect let alone the incremental increases along the way.

The lag comes into play when, for example, mortgages have to be renewed – which do not all happen in the same year, but over time. As interest rates rise the price of a house that a prospective buyer can afford declines due to increased monthly interest payments to buy that home. Therefore, prices go down. This is the same for bonds – as interest rates rise the value of a bond that has already been issued declines.

This was one of the main issues for Silicon Valley Bank (SVB); the U.S. government bonds that the bank held declined in value. This is only a problem for a bank if they have to sell the bond holdings, which SVB did because depositors demanded their money back, forcing SVB to have to sell these bonds at a loss. In short, SVB did not have enough assets to cover the withdrawals.

Download Your Free Guide

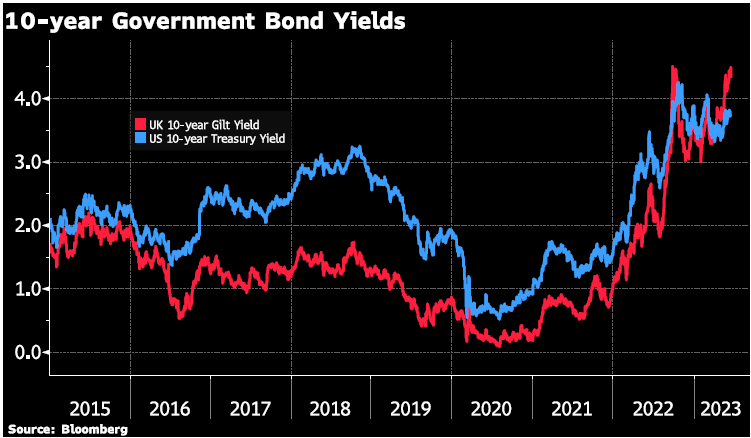

Governments are also paying higher costs to borrow money – interest rates on 10-year government bonds have risen sharply. This means that more of governments’ budgets will go to the cost of borrowing in the future – and with many advanced economies carrying high debt levels, this will add a significant burden to governments.

Jobs Data: Change our perspective?

In March we laid out several signs of recession for the U.S. economy in our post Reading the Signs: Is the U.S. Economy Headed for Recession? These signs are still apparent and deepening.

One contrary indicator that the U.S. Federal Reserve continues to look to is the amount of jobs available in the labour market compared to the labour force – this indicator by traditional measures does show that there are indeed still more jobs available than workers – which keeps the U.S. labour market statistics showing a ‘tight’ labour market.

However, new studies are showing that the post-covid labour market is different from pre-covid. One such paper from the National Bureau of Economic Research titled Where Are The Workers? From Great Resignation to Quiet Quitting? shows that workers are working less hours, largely for voluntary reasons, i.e. work life balance. This has employers hiring more workers to get the same amount of work done.

An article in the Wall Street Journal, Lots of Hiring, but Not So Much Working, also confirms this trend of Employees working fewer hours. The WSJ also points out that since covid companies resist layoffs even as economic weakness looms.

The average number of hours worked a week by private-sector employees declined to 34.3 in May, below the 2019 average and down from a peak of 35 hours in January 2021, according to the Labor Department.

A reduction in hours has historically meant layoffs are soon to follow. But not necessarily so this time around.

This time, that recession signal might be a false alarm because unusual post pandemic factors are at work. Indeed, even as employers cut hours, they are also adding workers—something they don’t usually do when contraction looms.

Payrolls rose by 339,000 in May and by nearly 1.6 million for the year to date. Layoffs were nearly 13% lower in April than in the average month in 2019, according to the Labor Department.

The expense and trauma of hiring have left employers unusually eager to avoid shedding staff they will need when business picks up again … Businesses are finally able to hire for long-unfilled positions, allowing overworked staff to return to more normal hours. Finally, workers are opting to work less, possibly because of a shift in work-life priorities.

The bottom line is that even the labour market is not as strong as it first appears, by historical measures. The higher interest rates are sure to cause financial and economic crises in the coming year.

Central banks are notoriously slow to change direction – but a change is coming, and as central banks lower rates and start up the money printing presses to put out the fires they created, gold and silver will rally again.

Did you see our interview with Chris Vermeulen last week? Chris joined GoldCore TV’s Dave Russell and explained why he’s feeling so bullish about gold in the long term, how he expects silver to fare in the coming months and which stock indices can give us a clue about what’s going on at the moment.

See the full 15 minute chat here. And, if you’re looking for more gold and silver market commentary then explore the rest of our YouTube channel where you’ll find all of our monthly chats with expert traders and analysts.

Chris Vermeulen on the gold price chart signal you don’t want to miss

From The Trading Desk

Market Update: The gold price fell to a three-month low on early trading Wednesday as the dollar held firm as traders considered the Federal Reserve’s next move.

US Federal Reserve Chair Jerome Powell is preparing to give testimony to Congress and the markets are betting on hawkish remarks that will stabilize the dollar.

Alternatively, if Powell’s remarks are on the cautious side, gold may get some support pushing prices higher.

UK inflation held at 8.7% in May against the expectation of slowing to 8.4%.

This in turn has pushed the chance of a 50 bps rate increase up from a previous estimate of 25 bps.

Stock Update – Silver Britannias - We have a limited number of Silver Britannia’s from the Royal Mint, with the lowest premium in the market at spot plus 40% for EU storage/delivery and for UK storage/delivery.

Gold 1oz Bars and Coins - GoldCore has excellent stock and availability on all gold coins and bars. Please contact our trading desk with any questions you may have.

Buy Gold Coins

GOLD PRICES ( AM/ PM LBMA FIX– USD, GBP & EUR )

| USD $ AM | USD $ PM | GBP £ AM | GBP £ PM | EUR € AM | EUR € PM | |

|---|---|---|---|---|---|---|

| 21-06-2023 | 1935.25 | 1925.65 | 1521.11 | 1514.33 | 1771.14 | 1762.74 |

| 20-06-2023 | 1953.85 | 1930.45 | 1528.11 | 1516.75 | 1787.38 | 1767.91 |

| 19-06-2023 | 1954.35 | 1951.15 | 1525.37 | 1524.63 | 1789.01 | 1786.86 |

| 16-06-2023 | 1964.10 | 1959.75 | 1535.34 | 1527.43 | 1794.40 | 1790.04 |

| 15-06-2023 | 1934.65 | 1952.35 | 1528.37 | 1534.35 | 1783.94 | 1791.09 |

| 14-06-2023 | 1951.90 | 1955.80 | 1543.95 | 1542.34 | 1806.48 | 1803.83 |

| 13-06-2023 | 1964.00 | 1954.40 | 1563.54 | 1553.16 | 1817.88 | 1810.75 |

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here