Gold Pension: Hold Gold In Your SIPP Or SSAS

Add Gold Bullion

To Your

Pension Today!

Hold gold bullion as part of your SIPP or SSAS

Invest in Gold Bullion as part of your UK Gold Pension

We understand that trying to decide how best to invest your pension can be difficult. Right now the state of the UK and wider global economy is a cause for concern, but particularly for those saving for retirement. Of course the future is always uncertain but with record levels of government debt, inflation and geopolitical crises, things feel more uncertain than ever. The traditional 60/40 allocation is no longer serving savers and investors in the long term.

The past has shown that traditional assets such as stocks and bonds have not served pension holders well in times such as these. In contrast gold bullion has a strong record of protecting portfolios during times of recession, inflation, uncertainty and war. In short, gold acts as insurance for your hard-earned wealth.

Gold Pensions

Since 2006 the UK Government has allowed pension owners to hold gold bullion as part of their SIPP or SSAS. Until this point no physical commodity could be held within a pension. Today physical gold bars are the only physical commodity that pension owners can purchase as part of their pension.

How can I get started with a Gold pension scheme?

Open an account with us today, or if you have one already login and select the relevant option. Your pension scheme provider manages the gold in your account, but it is up to you how you would like to best manage your investments. Through this account you can deposit funds, buy and sell gold bullion for your SIPP and SSAS.

GoldCore can work with your current SIPP or SSAS provider, but if you do not have one this is not a problem. Please let us know so we can send you a list of FCA-regulated and approved providers.

About GoldCore

GoldCore is one of the world's most respected and client-focused precious metal specialist providers. Established in 2003, we are experts in the purchase, sale and storage of physical gold and silver coins and silver bars. We have been offering gold bullion to pension holders since 2008.

Why should you hold gold in your pension?

Vision, Mission, and Philosophy

Our Vision

Our Mission

Our Philosophy

Why Goldcore

Established 2003

Over 14,500 clients

$1bn in Precious Metal Sales

Fully Allocated and Segregated Storage

One of the Largest Storage Networks in the Industry

4.8/5 Star Rating on Ekomi

Royal Mint Approved Distributor

Clients in 130+ countries

Steps To Hold Gold In Your Pension

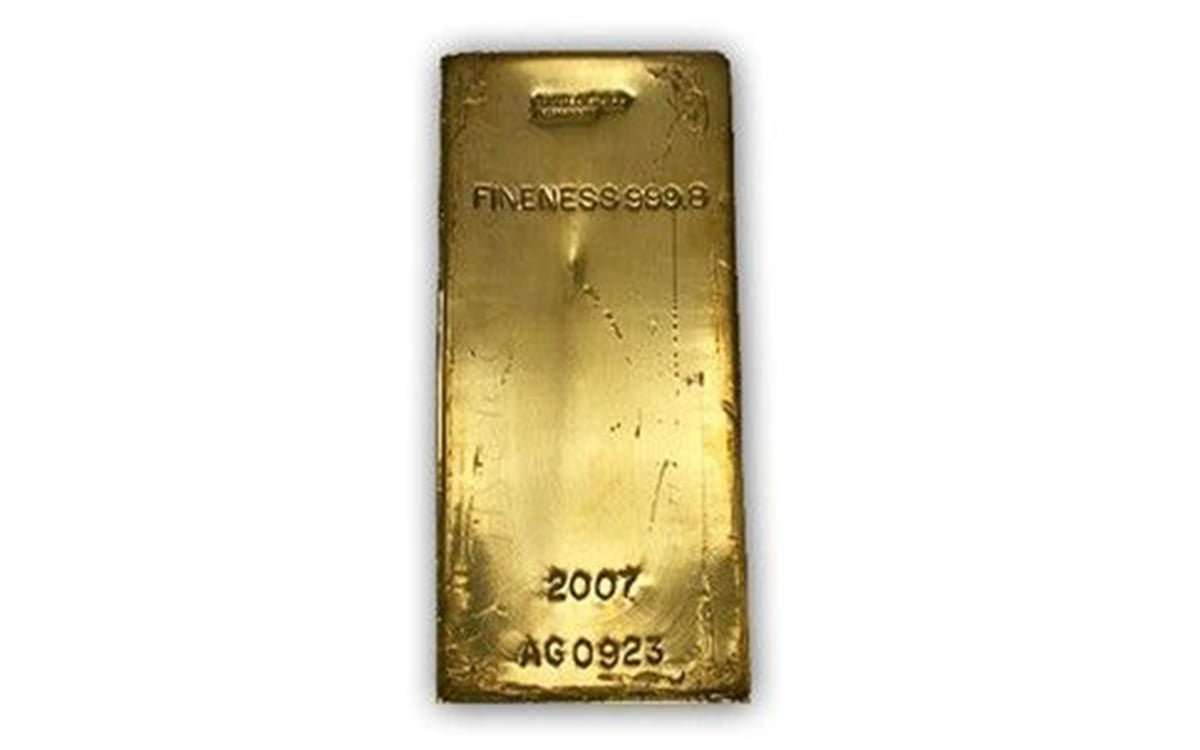

UK Pensions Approved Gold Bars

1 Ounce Gold Bar

10 Ounce Gold Bar

100 Gram Gold Bar

250 Gram Gold Bar

1 Kilo Gold Bar

400 Ounce Gold Bar

Frequently Asked Questions

Is Gold still a good investment?

Gold is a scarce asset. For millennia it has held its value and shown to act as a safe haven during uncertain times. Currently, we are facing exceptionally uncertain times as a decades long experiment to print money and exist in debt-based economies is beginning to backfire. Whether thanks to countries challenging US dollar hegemony, or markets refusing to support debt-laden economies, we are certain that our portfolios will need some level of insurance in the coming years, if not months. We believe gold is the best asset to do this.

What kind of gold can I hold in my pension?

Current regulations mean you can only hold gold bars in your pension. The bars must meet a certain criteria. The bars must be produced by one of the nine LBMA approved refineries and of at least 99.5% purity

As stated by HMRC, in 2006:

“gold of a purity not less than 995 thousandths, which is in the form of a bar, or of a wafer, of a weight accepted by the bullion markets”.

Investment grade gold bullion, therefore, needs to have a fineness (purity) of 0.995 or higher. GoldCore offers bars from a range of refineries, all of which are LBMA-approved.

How do I hold gold?

If you are looking to hold gold as part of your pension then please see the above steps as to how you can go about doing so. If you would like to hold gold outside of your pension then please visit this page to find out how to get started.

What is a SIPP and a SSAS?

Within the non-occupational self-directed scheme category, Self-Invested Personal Pensions (SIPPs) are the most common structure. They are specialised pension plans where the investor selects the assets to invest in and continuously manages the portfolio, either personally or through a financial advisor. SIPPs have long allowed for the holding of a vast array of various investments however it is only recently that gold bullion has been considered.

Within occupational self-directed or member-directed schemes, Small Self-Administered Schemes (SSASs) are the main type.

Your gold investment will be wrapped by independent SIPP administrators that are FCA-approved. SSASs are not currently FCA regulated.

SIPPs and SSASs are both money purchase schemes, or defined contribution schemes, but they have an element of self-direction as regards the investment allocation decisions.

Do I own the gold in my pension?

When you purchase the gold in your SIPP or SSAS then you are not the legal owner of the gold. Instead, your SIPP or SSAS is the owner of the gold.

Can anyone hold gold in their pension?

You can hold gold as part of your SIPP or SSAS but not a company pension, personal pension, or stakeholder pension.

My current pension provider does not allow me to hold gold as part of my pension. What should you do?

If your current SIPP or SSAS provider does not allow you to hold gold as part of your pension then it is possible to change provider. Please contact us for our list of UK pension providers that are happy for pension owners to have gold in their pension. Please note fees may apply when changing provider.

Can I hold gold coins in my SIPP or SSAS?

No, gold coins are not included in the HMRC definition of investment gold that can avail of tax relief in UK self-directed pension schemes.

Can I hold silver in my SIPP or SSAS?

No, you can't hold silver, you can only hold gold bars in your pension. The bars must be produced by one of the nine LBMA-approved refineries and of at least 99.5% purity.

What size gold bars can I hold in my SIPP or SSAS?

You can buy any LBMA approved sized gold bar offered by GoldCore from 100g up to 400 oz bars.

How can I buy gold with my pension?

There are three ways you can buy gold bars with your pension:

1) Buy through a new SIPP or SSAS that is separate from other pensions.

2) Buy gold bullion through your existing SIPP or SSAS.

3) Transfer part or all of your current pension to a SIPP or SSAS.

An independent financial advisor can provide you with more information on what is best suited to your requirements.

What is the minimum amount of gold I can hold in my pension?

At GoldCore £30,000 is the minimum investment for a gold bullion pension scheme.

Where is my gold bullion stored?

We offer allocated and segregated, high-security storage vaults in a number of locations, around the globe. You and your pension provider must decide where you would prefer to hold your gold.

Is my gold bullion insured?

Yes, all gold held and stored by GoldCore is insured by Lloyd's of London. We have one of the largest networks of storage, logistics, and insurance partners who work with us to safeguard our clients’ stored precious metals.

Can I take delivery of my gold?

When you hold gold as part of your pension then you cannot take delivery of it. This is because the bars are technically owned by the pension scheme and so must be held in custody by them on your behalf.

Is gold in my pension tax-free?

You do not pay CGT or VAT on investment-gold bars when held within a pension scheme. Pension scheme contributions are also viable for up to 45% tax relief (depending on your tax bracket) up to a maximum threshold.

Is it better to buy gold through my pension or with liquid cash?

There are advantages to both and this is definitely something that is worth discussing with a financial advisor. The advantage to buying gold with liquid cash is that you can sell it and realise the gains instantly. Whereas with gold in a pension you cannot do this until you are able to start drawing funds from your pension (usually from the age of 55).

When you buy gold for your pension then you can claim up to 45% tax relief on the money contributed. You also do not pay Capital Gains Tax on gold held within your pension.

Do I pay storage fees on gold in my pension?

Gold bullion storage fees must be paid with cash from your SIPP or SSAS pension. A bank account that is linked to SIPP/SSAS accounts can be used to store funds for the purpose of paying fees. We recommend you leave enough money on deposit to cover any future storage fees.

Can I transfer the gold bar from my SIPP or SSAS to my personal account?

No, it is not possible to transfer gold bars from your pension account into your personal account.

When I sell the gold in my pension, how is this money taxed?

Please refer to your pension trustee or tax advisor for any tax related enquiries.

Do I need to have an IFA in order to buy gold through my SIPP or SSAS?

It is not a legal requirement for you to have an IFA to buy gold through your SIPP or SSAS however, the majority of SIPP and SSAS providers will not deal directly with individuals.

Please note, If you do not currently have a SIPP provider in the United Kingdom, you will need to have an Independent Financial Advisor (IFA) in place before contacting our SIPP provider.

If you currently do not have an Independent Financial Advisor (IFA ) we work with IFA's in the United Kingdom and can provide you wioth their contact details also.